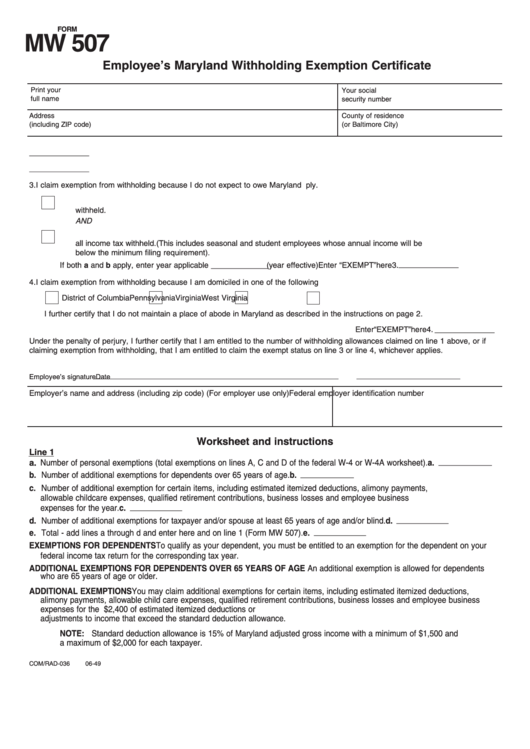

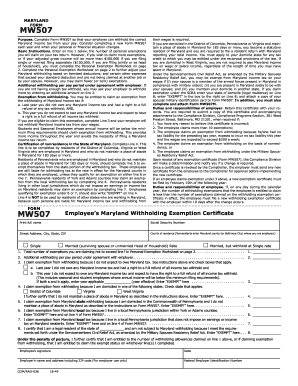

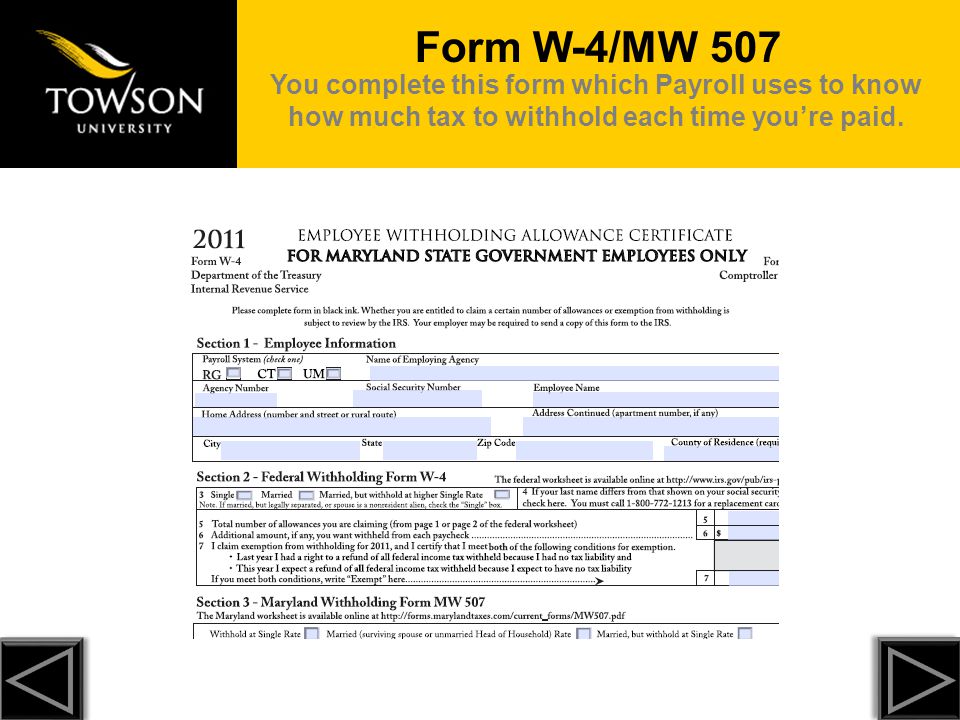

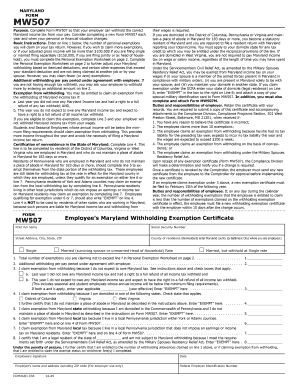

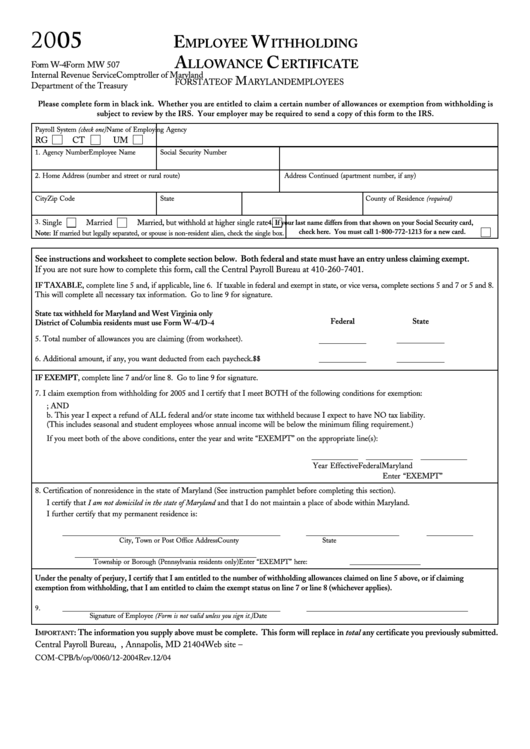

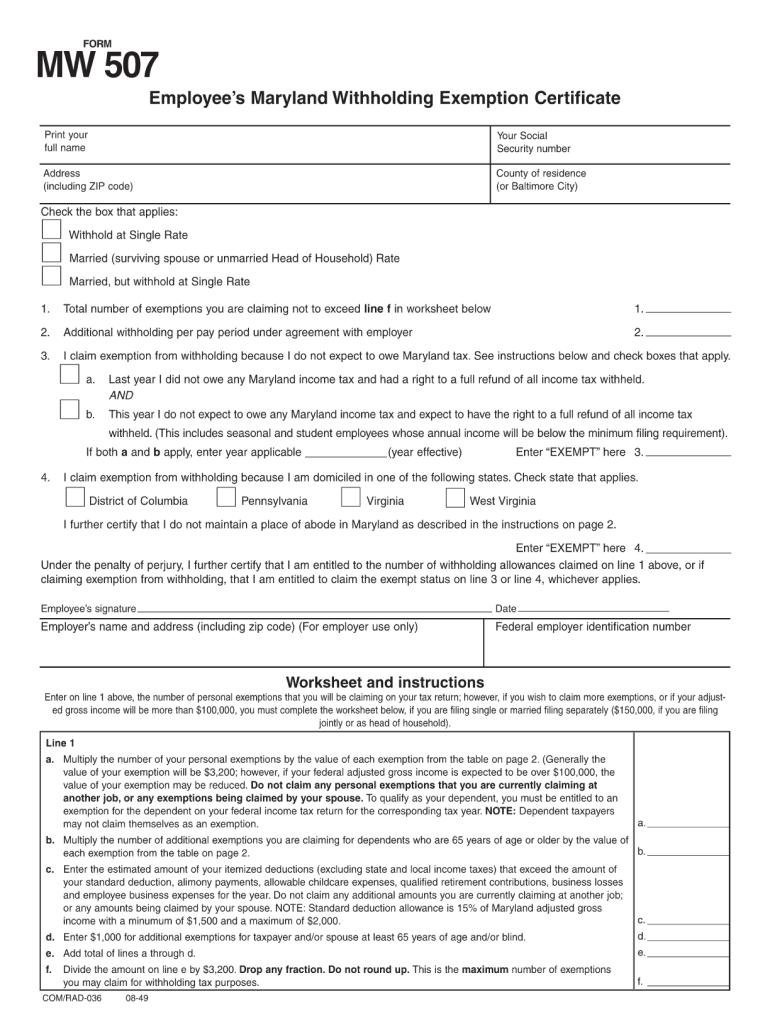

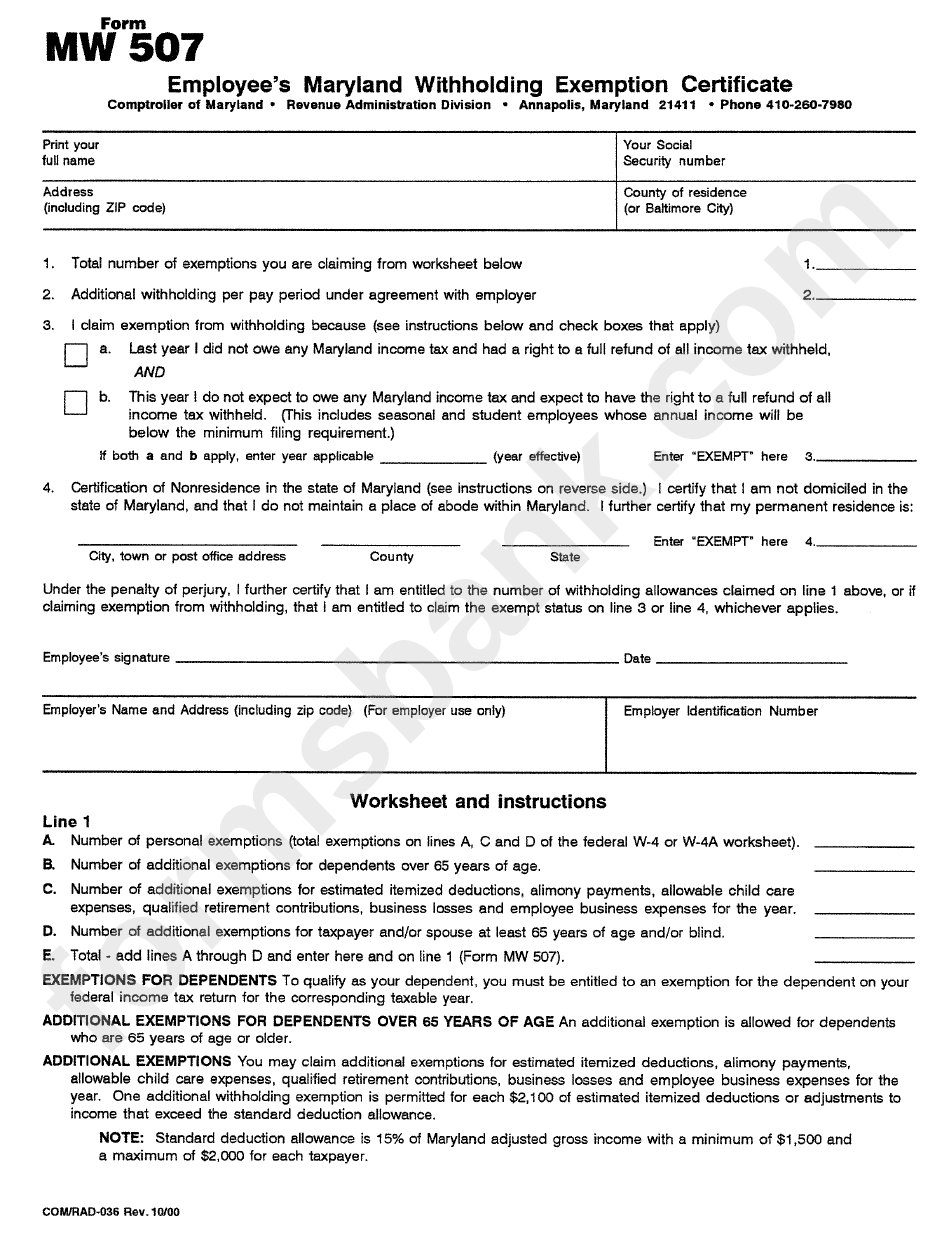

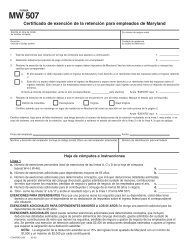

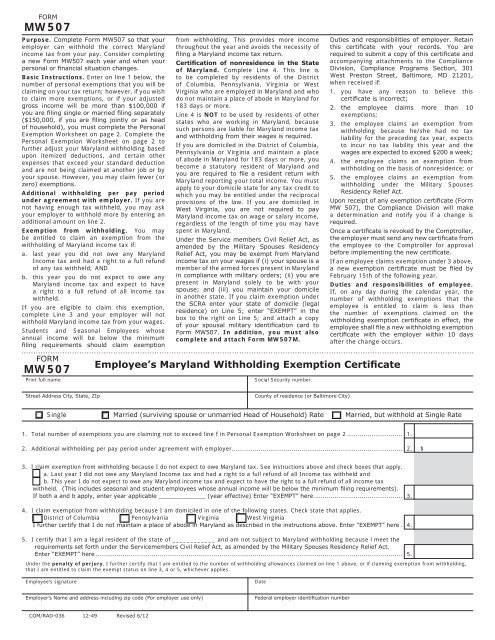

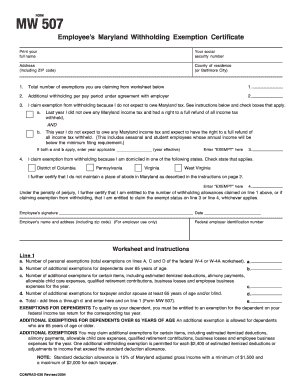

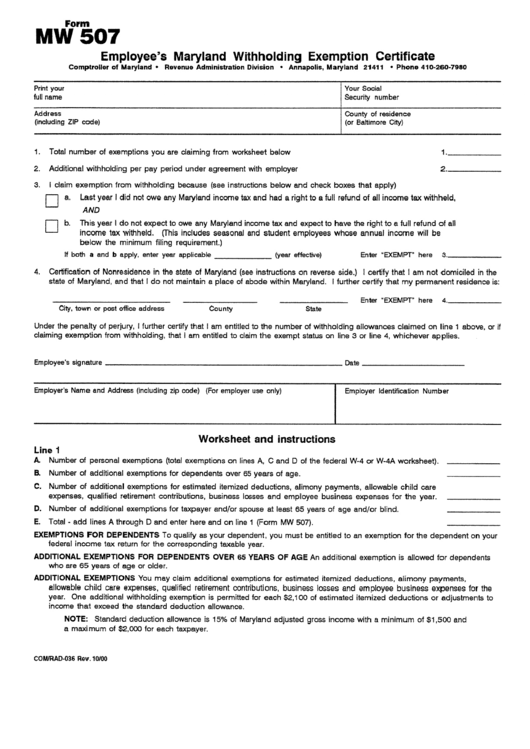

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changesMaryland Form MW 507, Employee's Maryland Withholding Exemption Certificate Maryland Form MW 507 (pdf 692KB)BMW 507 with optional detachable hardtop The 507 frame was a shortened 503 frame, the wheelbase having been reduced from 2,5 millimetres (1116 in) to 2,480 millimetres (98 in) Overall length was 4,385 millimetres (1726 in), and overall height was 1,257 millimetres (495 in) Curb weight was about 1,330 kilograms (2,930 lb)

Mw 507 Bl ラフィネ トールポット 1個 アビテ 通販サイトmonotaro

Mw 507

Mw 507-Online Withholding Calculator For Tax Year 19 Payroll Frequency Weekly BiWeekly SemiMonthly Monthly Quarterly Annually Lump Sum Daily Number of Exemptions from MW507 Form Total Wages County of Residence*Apr 07, · The Maryland Form MW 507 is the Employee's Maryland Withholding Exemption Certificate The MW507 form must be completed so that you know how much state income tax to withhold from your new employee's wages

Federal And State W 4 Rules

Who may file – Any recipient of an annuity, sick pay or retirement distribution payment may file this form to have Maryland income tax withheld from each paymentM = Married Second and Third Positions Enter the number of exemptions claimed Additional InformationFill out MW507 MW507 The Comptroller Of Maryland in a few clicks following the recommendations below Choose the template you require in the library of legal forms Select the Get form button to open the document and begin editing Fill out the requested fields (these are yellowcolored)

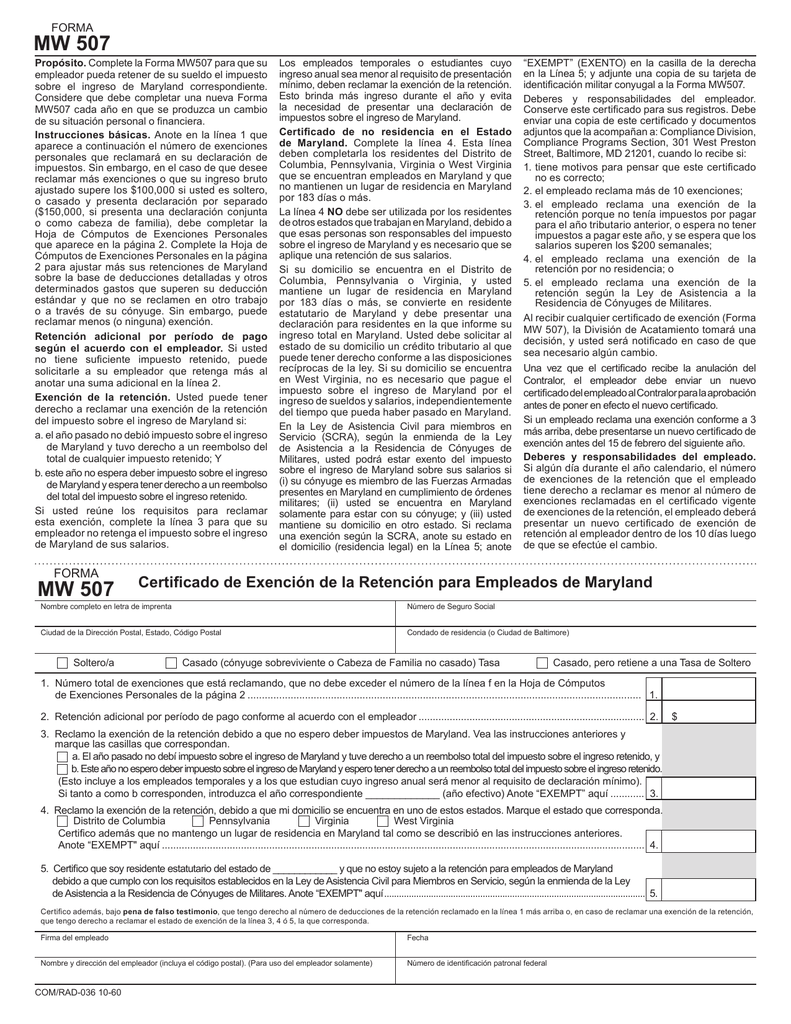

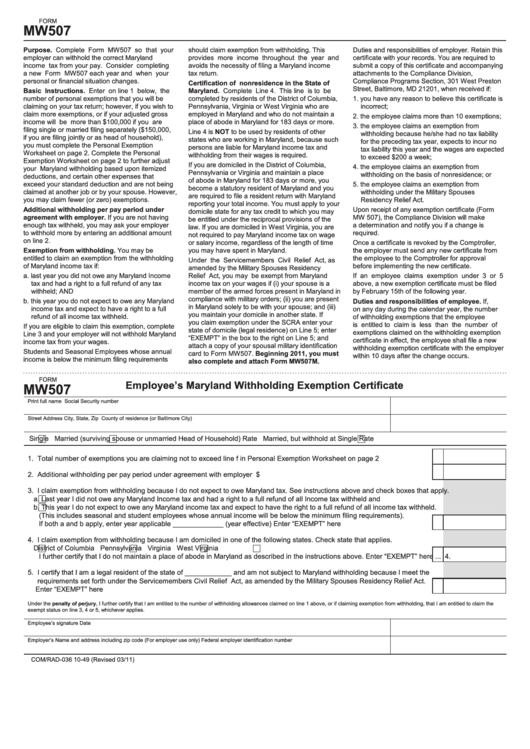

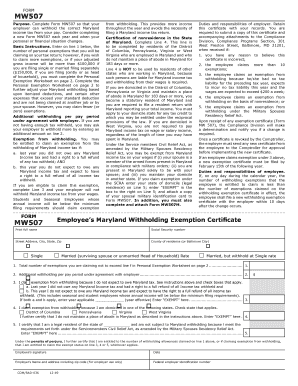

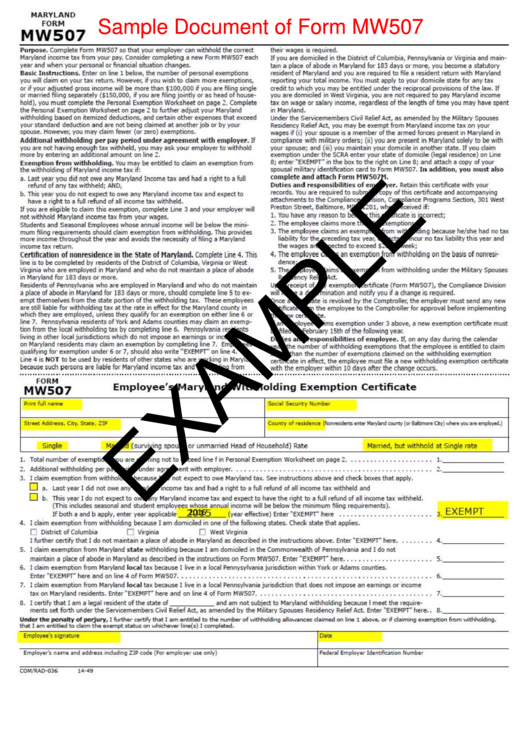

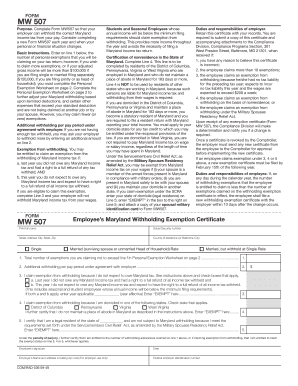

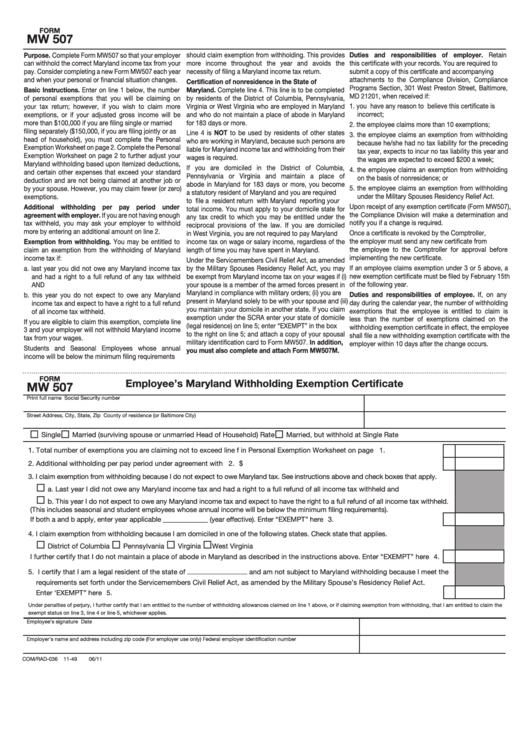

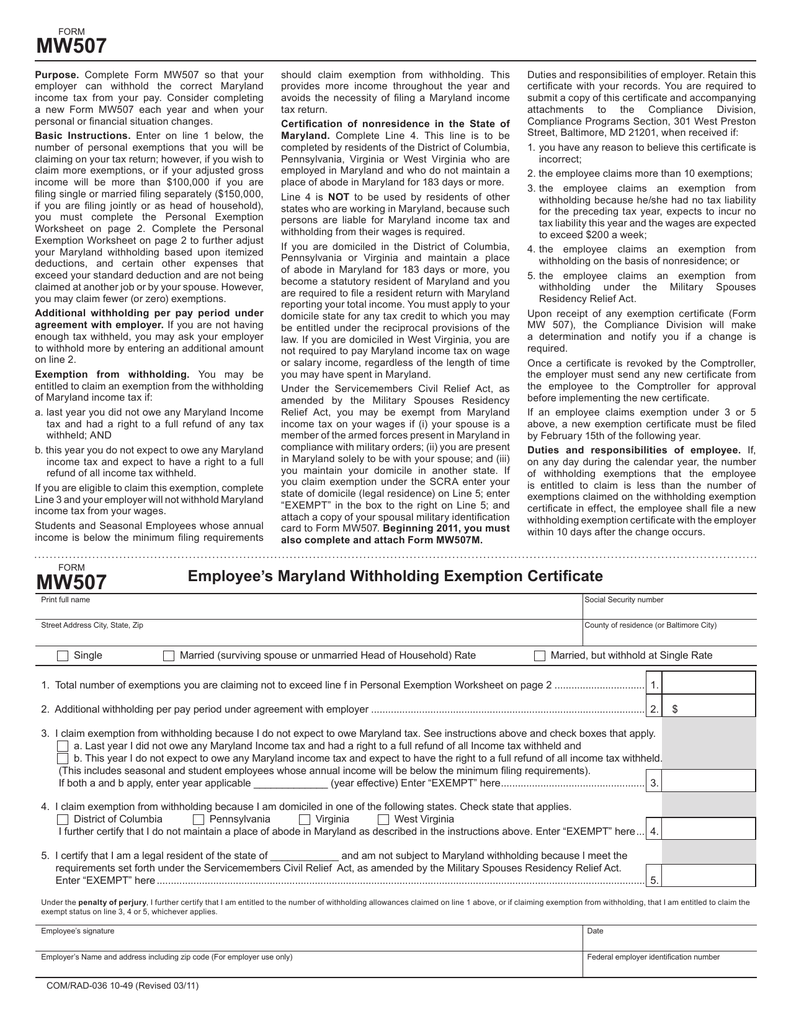

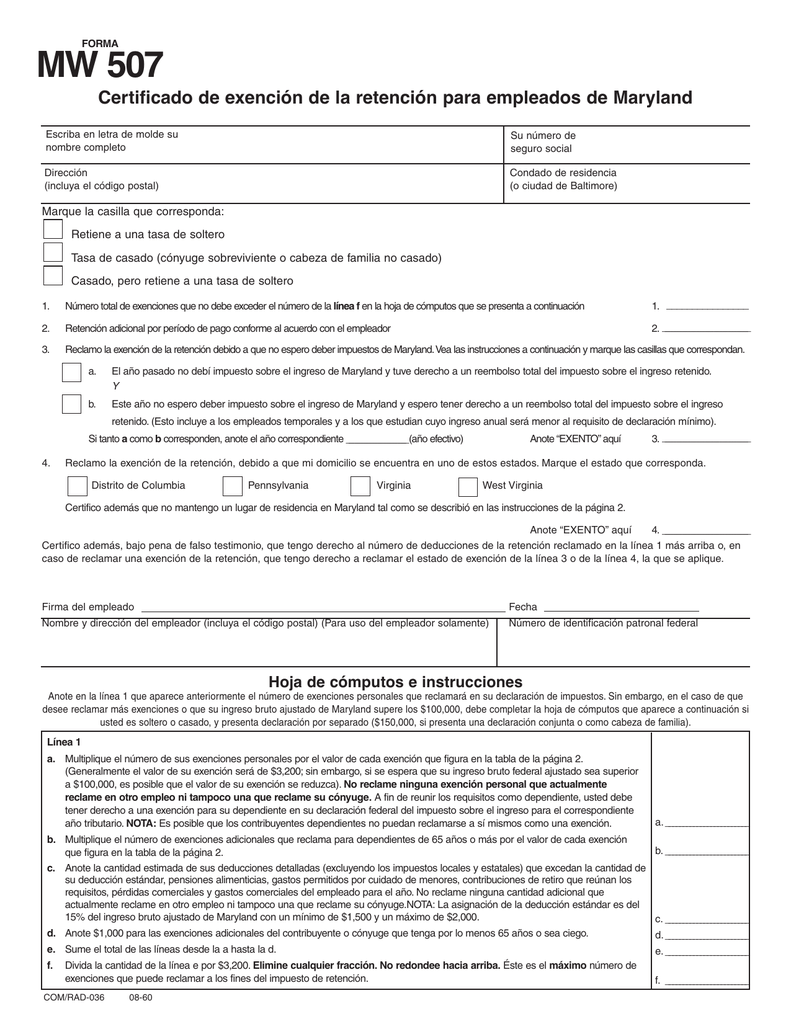

MW507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions you will claim on your tax return However, ifSep 17, 19 · The California Office of Tax Appeals ("OTA") recently issued a decision finding that a nonresident sole proprietor, who performed all services outside of California but performed such services for California customers, was operating a "unitary" business and was therefore subject to California's apportionment rulesi The Bindley decision was rendered in late May 19, but theMW507 is also useful for employees to declare exemptions from withholding Your Responsibility as an Employer When an employee provides you with a MW507, you must retain the certificate with your records

Sample Document of Form MW507 16 Author Snagit User Subject Screen Capture by SnagitMD MW507 Date01/25/21 Description W4 Withholding Form Date01/25/21 Description work permit for 13 year olds ONLY Date01/25/21 DescriptionWork permit for youth who are not 14 But will be 14 by June 25, 21 ALL OTHER YOUTH 14 17 MUST APPLY ONLINE ON DLLR WEBSITE YW Application Signature PageDomestic Mail Manual • Updated 621 507 Additional Services Treatment of Mail 122 Charges For 3 years after the date when the new address information appears in Address

Fillable Form Mw 507 Employee S Maryland Withholding Exemption Certificate Printable Pdf Download

Mw507 Fill Out And Sign Printable Pdf Template Signnow

BMW produces motorcycles under the BMW Motorrad division, and also owns both the MINI and RollsRoyce marques At Classic Driver, we offer a worldwide selection of BMW 507s for sale Use the filters to narrow down your selection based on price, yearForm MW507 Employee Withholding Exemption Certificate 21 Comptroller of Maryland FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY Section 1 – Employee Information (Please complete form in black ink) Payroll System (check one) RG CT UM Name of Employing Agency Agency Number Social Security Number Employee NameMW507 Print full nam@ Directions for the Completion of the Maryland MW507 Complete the top portion with your information (name, address, Social Security number, etc) County of Residence o Resident of Maryland Enter your county here (Anne Arundel, Howard, etc) o From Out of State Enter Baltimore City

The Following Information Is Educational Information And Not Advice Ppt Video Online Download

Solved Milliliters Ml Ml Make The Following Conversions Chegg Com

We last updated Maryland MW507 in February 21 from the Maryland Comptroller of Maryland This form is for income earned in tax year , with tax returns due in April 21 We will update this page with a new version of the form for 22 as soon asHowever, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced Do not claim any personalMay 28, 18 · mw507 form help When submitting the Maryland form, you also want to be included in a duplicate of Delaware returns You can save the completed form in your company and update it as needed The W4 module includes a support sheet that will allow you to practice This module collects basic biographical information on candidates

Texas Attorney General Opinion Mw 507 The Portal To Texas History

Habiter ラフィネ トールポット ホワイト Mw 507 Wh

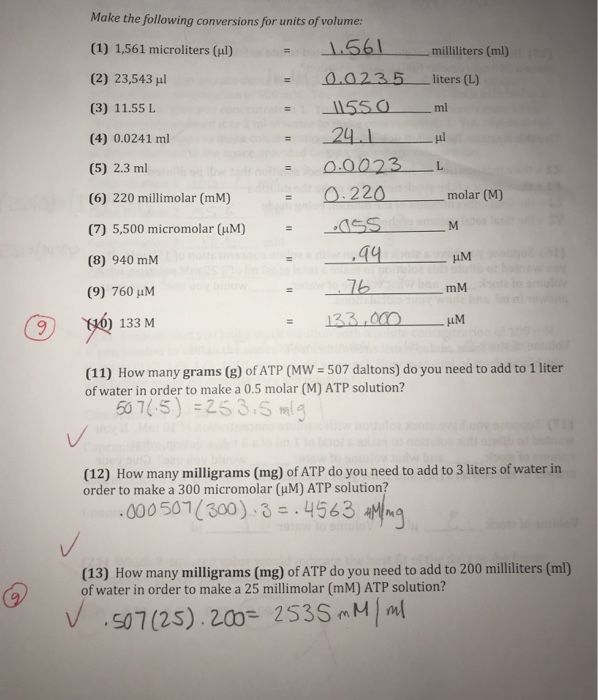

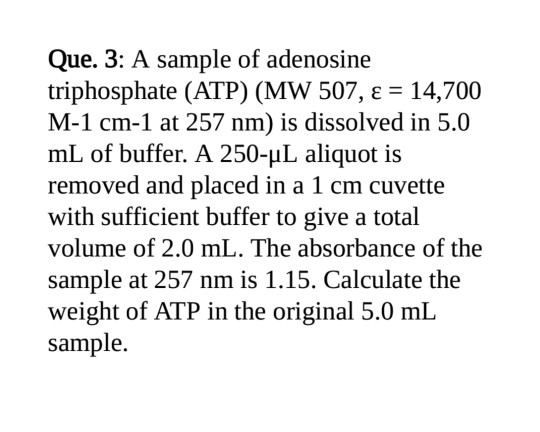

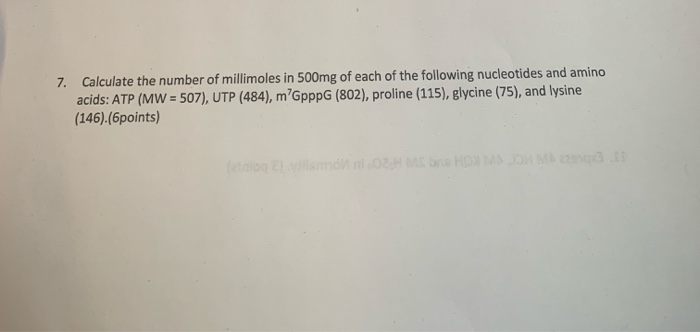

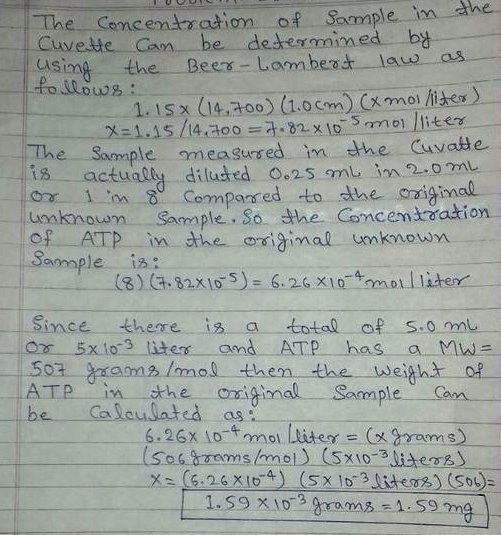

Oct 25, 19 · Mw507 Single Student, live at home, with part time server job Do I claim 1 on mw507 And 0 in everything else?A sample of adenosine triphosphate (ATP) (MW 507, ε = 14,700 M −1 cm −1 at 257 nm) is dissolved in 50 mL of buffer A 250μL aliquot is removed and placed in a 1 cm cuvette with sufficient buffer to give a total volume of mLThe absorbance of the sample at 257 nm is 115 Calculate the weight of ATP in the original 50 mL sampleJan 01, 16 · Displaying 1 total results for classic BMW 507 Vehicles for Sale

5 Gallon Marine Water Tank

Form Mw507m Exemption From Maryland Withholding Tax For A Qualified Civilian Spouse Of Military

Maintain a place of abode in Maryland as described in the instructions on Form MW507 MARYLAND FORM MW507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your payComptroller Franchot Announces FirstintheNation Prohibition on Sales of Disposable Flavored ECigarettes Check out the "News" menu for this and other important information you need to know!The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages The importance of having each employee file a state withholding certificate as well as a federal Form W4 cannot be overstated, so make its completion a priority

Taxhow Tax Forms Maryland Form Mw507

Free Maryland Form Mw 50 Pdf 609kb 2 Page S Page 2

MW 507), the Compliance Division will make a determination and notify you if a change is required Once a certificate is revoked by the Comptroller, the employer must send any new certificate from the employee to the Comptroller for approval before implementing the new certificate If an employee claims exemption under 3, 4 or 5MW507 Instructions — WITH Allowances Disclaimer The material contained herein is for informational purposes only and does not constitute tax advice Complete the top portion with your information (name, address, Social Security number, etc) County of Residence o Resident of Maryland Enter your county here (Anne Arundel, Howard, etc)1959 bmw 507 values and more The Hagerty classic car valuation tool® is designed to help you learn how to value your 1959 bmw 507 and assess the current state of the classic car market

Maryland

How To Fill Out Mw507 Form Single And Married Examples Easy Info Blog

We last updated Maryland MW507M in March from the Maryland Comptroller of Maryland This form is for income earned in tax year , with tax returns due in April 21We will update this page with a new version of the form for 22 as soon asHelp for Sections 2 Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit If you have a household with two jobs and both pay about the same click this button and exitSep 21, · Form MW 507, Employee's Maryland Withholding Exemption Certificate You can send the completed form and any required attachments by fax to (2) 566 5001 or by mailing your documents to DC Retirement Board Member Services Center 900 7th

Mw 507 Mw 507 Maryland Tax Forms And Instructions

مشخصات قیمت و خرید ساعت مچی عقربه ای مردانه سوکا مدل Mw507 دیجی کالا

Upon receipt of any exemption certificate (Form MW 507), the Compliance Division will make a determination and notify you if a change is required Once a certificate is revoked by the Comptroller, the employer must send any new certificate from the employee to the Comptroller for approval before implementing the new certificateQuestion How many milligrams (mg) of ATP (mw = 507 daltons) do you need to add to 100 milliliters (ml) of water in order to make a 50 millimolar (mm) solution?BMW introduced their 507 roadster in 1956 Intended to be based on the BMW 501 platform, the 507 was created largely by the urging of BMW's American importer Unfortunately, due to high development costs, high price and lack of interest, the 507 was an expensive, poor selling car

M A R Y L A N D M W 5 0 7 Zonealarm Results

No Idea How To Fill Out Mw 507 Fill Online Printable Fillable Blank Pdffiller

How many milligrams (mg) of ATP (mw = 507 daltons) do you need to add to 100 milliliters (ml) of water in order to make a 50 millimolar (mm) solution?(form MW507), the Compliance Division will make a determination and notify you if a change is required Once a certificate is revoked by the Comptroller, the employer must send any new certificate to the Comptroller for approval before implementing the new certificate If an employee claims exemption under 3, 4 or 5State Offices are closed Friday June 18, 21 in recognition of the federal and state Juneteenth Holiday* Learn how to PROTECT Elders from financial exploitation by clicking on our "Security" menu and "Elder Financial Abuse" Download our convenient brochure filled with prevention tips, resources, and more!

Renaldisease Instagram Posts Photos And Videos Picuki Com

1 Md Wh Form Mar 25 15 Form Mw 507 Purpose Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Your Pay Course Hero

Form MW507 Employee Withholding Exemption Certificate Comptroller o r Maryland FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY Section 1 – Employee Information (Please complete form in black ink) Payroll System (check one) RG CT UM Name of Employing Agency Agency Number Social Security Number Employee NameJan 18, 19 · This BMW 507 roadster is a later series II example and was completed and delivered on 10 July 1958 to G Dagmar in Munich, Germany The car was originally finished in Spring White and included the attractive removable hardtop The car was then sold to Werner Preis in Dusseldorf According to BMW Group Archive, at some point in the car's lifeJan 04, 21 · I am filling out my MW507 form and I am trying to figure how many exemptions I can claim I am a single mother with 2 Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website

Esi Lcms Results Show Selective Uptake And Conversion Of Pcdps Download Scientific Diagram

Top 6 Mw507 Form Templates Free To Download In Pdf Format

Ahmed MW is on Facebook Join Facebook to connect with Ahmed MW and others you may know Facebook gives people the power to share and makes the world more open and connectedMW507 form for resident aliens MD MW507 instructions Complete all the fields of the general information section (Name, social security number if any, address, and marital status, county) Line 1 Complete line 1 using the worksheet on page 2 Line 2 Complete this line only if you want additional taxes taken out of your paycheckComplete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions you will claim on your tax return

Archive It S Hard To Beat Perfection The Bmw 507 Roadster

Mw 507 Fill Out And Sign Printable Pdf Template Signnow

Personally I earn mostly cash tips so I want to claim 0 on my mw507 for taxes, I also claim 0 for w4 0 3 281 Reply 3 Replies Critter Level 15 October 26, 19 128 PM Mark as NewForm MW507 Employee Withholding Exemption Certificate Comptroller or Maryland FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY Section 1 – Employee Information (Please complete form in black ink) Payroll System (check one) RG CT UM Name of Employing Agency Agency Number Social Security Number Employee NameMw507 formn iOS device like an iPhone or iPad, easily create electronic signatures for signing a mw507 in PDF format signNow has paid close attention to iOS users and developed an

Milky Way Baby Bootie Soap Mold Mw 507 Wholesale Supplies Plus

Texas Attorney General Opinion Mw 507 The Portal To Texas History

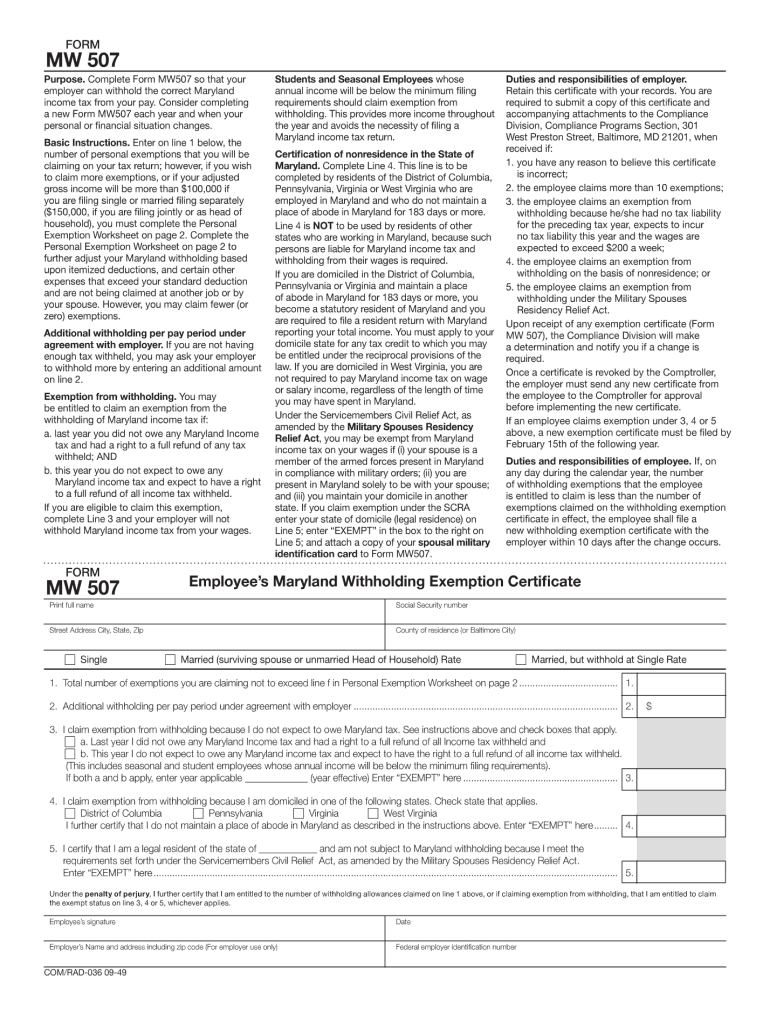

Jun 24, · MW 507 Basis for Withholding State Exemptions Acceptable Exemption Data S/M, Number of Allowances TSP Deferred Yes Special Coding Determine the Total Number of Allowances Claimed field as follows First Position S = Single;MW507 page 2 Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;

Federal And State W 4 Rules

Md Comptroller Mw 507 09 Fill Out Tax Template Online Us Legal Forms

Maryland

Mw 507 Bl ラフィネ トールポット 1個 アビテ 通販サイトmonotaro

17 Md W4 Withholding Tax Payments

Form Mw507 Employee S Maryland Withholding Exemption Certificate

Free Maryland Form Mw 50 Pdf 609kb 2 Page S Page 2

Top 6 Mw507 Form Templates Free To Download In Pdf Format

Maryland

Que 3 A Sample Of Adenosine Triphosphate Atp Mw Chegg Com

State W 4 Form Detailed Withholding Forms By State Chart

Tru Components Zener Diode Tc Zpd5 1 Enclosure Type Semiconductors Do 35 Zener Voltage 5 1 V Power Max P Tot 507 Mw Conrad Com

Maryland State Form W 4 Download

Form Mw507 Employee S Maryland Withholding Exemption Certificate

A Raman Spectra For Acc 507 Activated Carbon Electrode Operating Download Scientific Diagram

Characterization Of The Antimonial Antileishmanial Agent Meglumine Antimonate Glucantime Antimicrobial Agents And Chemotherapy

Employee S Maryland Withholding Exemption Certificate

Mw 507 Withholding Tax Tax Deduction

Mw 507 Withholding Tax Tax Deduction

Md Comptroller Mw 507 08 Fill Out Tax Template Online Us Legal Forms

File Bmw 507 Red Hl Tce Jpg Wikimedia Commons

Md Comptroller Mw 507 21 Fill Out Tax Template Online Us Legal Forms

Md Comptroller Mw 507 18 Fill Out Tax Template Online Us Legal Forms

Form Mw 507 Employee S Maryland Withholding Exemption Certificate Printable Pdf Download

New Autumn Winter Fashion Suede Leopard Shorts Women Vintage Slim Wide Legs Shorts Loose Sequined High Waist Shorts Female Mw507 Shorts Aliexpress

Maryland

Fill Free Fillable Towson University Form W 4 Employee Withholding Allowance Certificate Pdf Form

Fillable Form Mw507 Employee S Maryland Withholding Exemption Certificate Printable Pdf Download

Mw507 Example Fill Online Printable Fillable Blank Pdffiller

Form Mw507 Fillable Employee S Maryland Withholding Exemption Certificate

日限定07 アビテ ラフィネ トールポット ブルー Mw 507 Bl ポット 鉢 アイアン ブリキポット 170 はなどんやアソシエ 通販 Yahoo ショッピング

Form Mw 507 Employee S Maryland Withholding Exemption Certificate Printable Pdf Download

Mw507

Mw 507 Maryland Tax Forms And Instructions

Annuity And Sick Pay Request For Maryland Income Tax Withholding

M A R Y L A N D W I T H H O L D I N G E X E M P T I O N F O R M Zonealarm Results

Abnova Human Nova1 Full Length Orf Np 2 1 A A 507 A A Recombinant Protein Mw

France Awards 507 Mw In Second Pv Tender Taiyangnews

Solved 7 Calculate The Number Of Millimoles In 500mg Of Chegg Com

Instructions Employee Withholding Allowance Certificate W 4 Mw

Mw 507

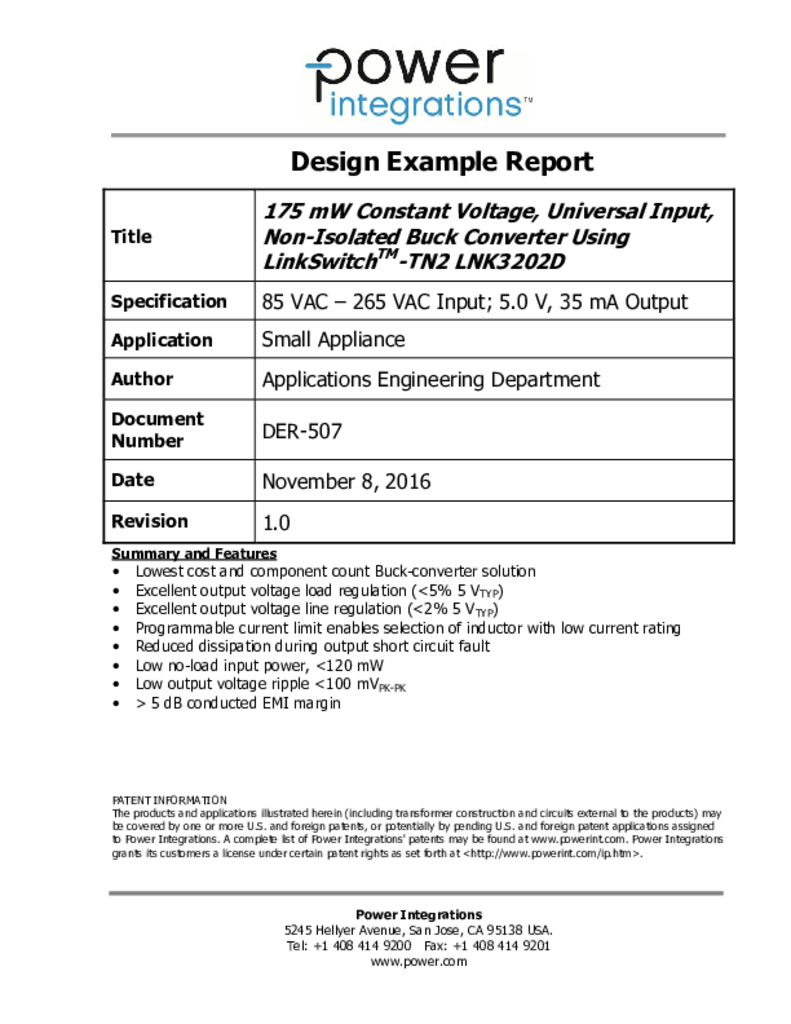

Der 507 175 Mw Constant Voltage Universal Input Non Isolated Buck Converter Power Integrations Inc

Download Maryland Form Mw 507 For Free Page 2 Formtemplate

A Sample Of Adenosine Triphosphate Atp Mw 507 Math Varepsilon 14 700 M 1 Mathrm Cm 1 Math At 257 Nm Is Dissolved In 5 0 Ml Of Buffer A 250 Math Mu Mathrm L Math Aliquot Is Removed And Placed In A 1

Mw507 Copy Copy Com Rad 036 09 49 Form Mw 507 Purpose Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Course Hero

Md Withholding Form Pdf Format Iatse Local 22

Bill Of Sale Form Maryland Form Mw 507 Templates Fillable Printable Samples For Pdf Word Pdffiller

Mw 507 Withholding Tax Tax Deduction

Form Mw 507 Employee S Maryland Withholding Exemption Certificate Printable Pdf Download

Texas Attorney General Opinion Mw 507 The Portal To Texas History

Free Maryland Form Mw 50 Pdf 609kb 2 Page S

0 件のコメント:

コメントを投稿